Medical and Pharmacy Coverage

Medical Plans

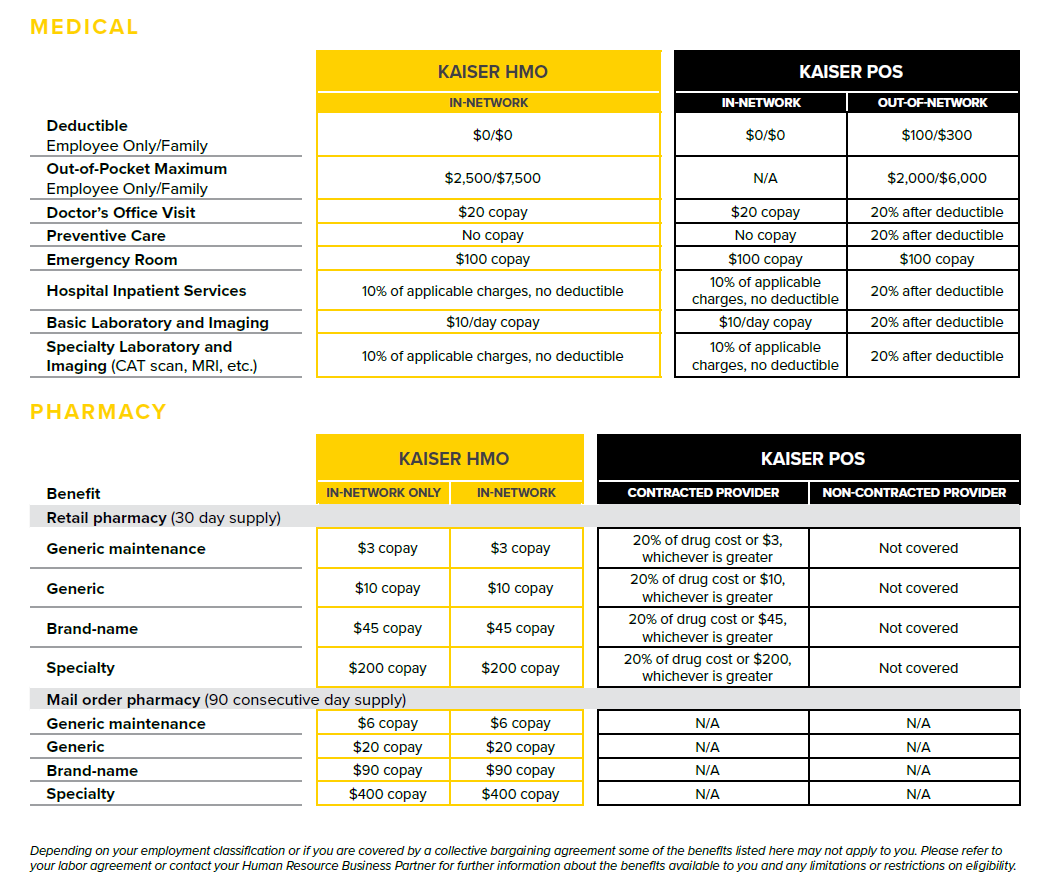

Hertz understands the importance of medical coverage for you and your dependents. You may choose between two plans, both administered by Kaiser Permanente: the Kaiser HMO or the Kaiser POS (Added Choice). Both plans cover the same medical services, use Kaiser providers for in-network care, and cover in-network preventive care at 100%. They offer the same health care management programs and resources. And you can earn wellness incentives with both plans. There are two major differences between the plans:

- The providers you can use. With the Kaiser POS (Added Choice) Plan, you can choose to use out-of-network providers, but you’ll receive greater cost savings when you stay in-network. With the Kaiser HMO Plan, only Kaiser providers are covered.

- Your deductibles and out-of-pocket maximums. With the Kaiser POS (Added Choice) Plan, you’ll pay a deductible if you choose out-of-network providers. The Kaiser HMO Plan has a higher out-of-pocket maximum.

Read this if you will be traveling outside Kaiser Permanente areas.

Pharmacy Benefits

Kaiser also manages the pharmacy benefits. The Kaiser HMO only covers in-network prescription drugs. The Kaiser POS (Added Choice) covers in-network and out-of-network prescription drugs.

Compare the medical plans:

For More Information

Review your claims, find medical providers, get estimates of treatment costs, schedule appointments, refill prescriptions, and download the Kaiser app using the Kaiser Permanente website. You can also call (800) 966-5955.

Transparency in Coverage Information – If you would like would like to see pricing information for covered items and services for UMR in-network and out-of-network provider rates, click here. This URL link is being provided to you as a fulfillment of our requirement to you to provide transparent pricing information, effective July 1, 2022.

Costs for Coverage

When you enroll, you will be able to see the medical coverage rates.